Assume Amp Corporation Calendar Year End Has 2024

Solved a. what is the maximum amount of 179 expense amp may. 2022 following assume. Problem following solved lo information expense tdw acquired income purposes taxable computing assume corporation calendar end during company year assets. Corporation assume answered bartleby. Solved assume that tdw corporation (calendar year-end) has. Required information [the following information applies to the. Assume amp corporation calendar year end has 2021. Assume that tdw corporation (calendar-year-end) has 2019 taxable income

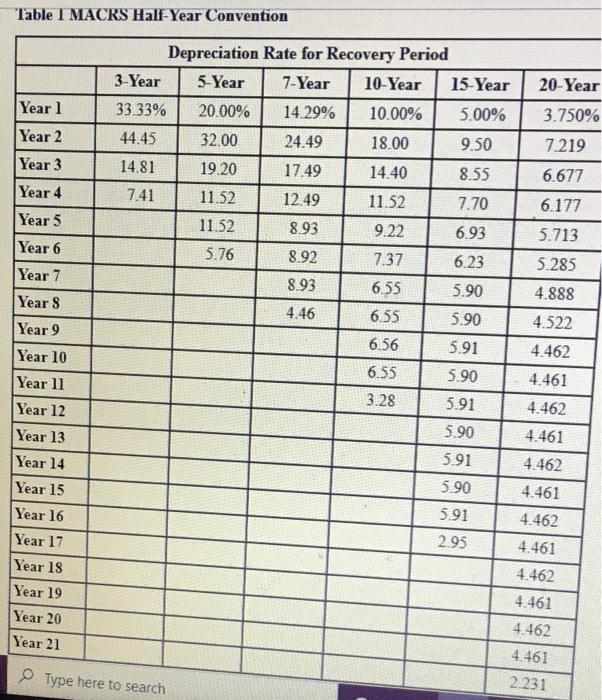

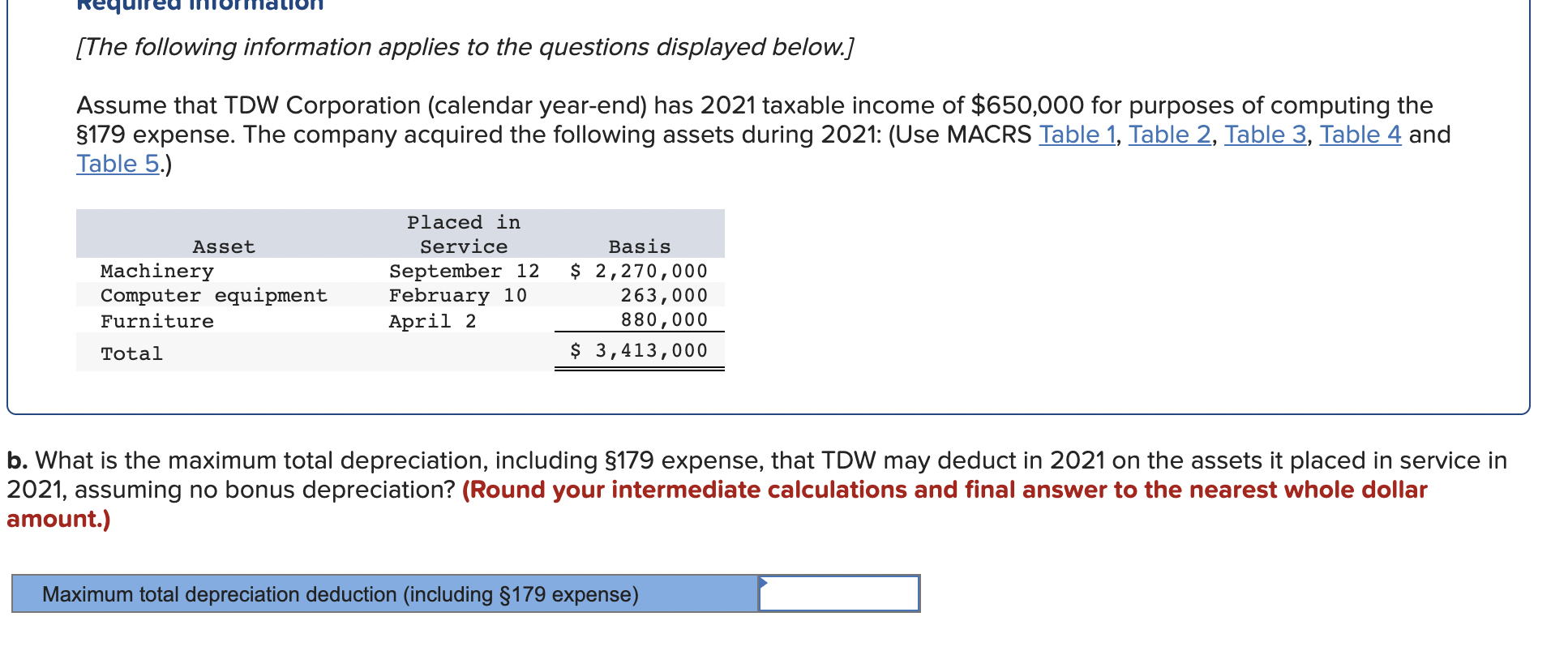

Solved Assume That TDW Corporation (calendar Year-end) Has | Chegg.com

Photo Credit by: www.chegg.com

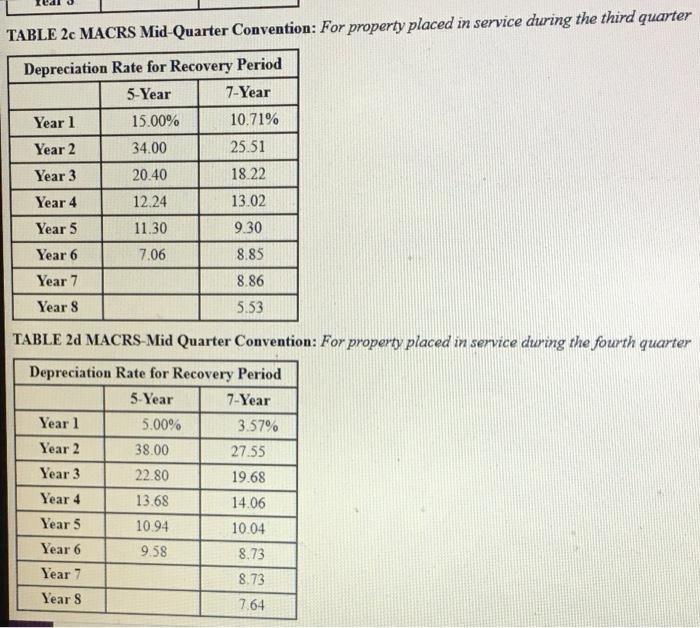

Solved Assume That TDW Corporation (calendar Year-end) Has | Chegg.com

Photo Credit by: www.chegg.com

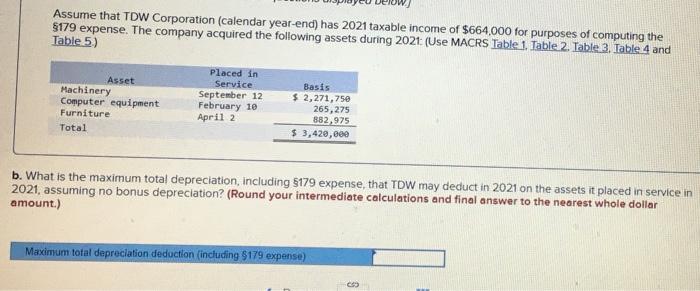

Solved Assume That TDW Corporation (calendar Year-end) Has | Chegg.com

Photo Credit by: www.chegg.com

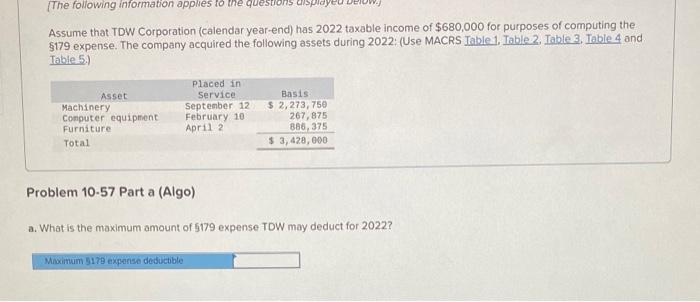

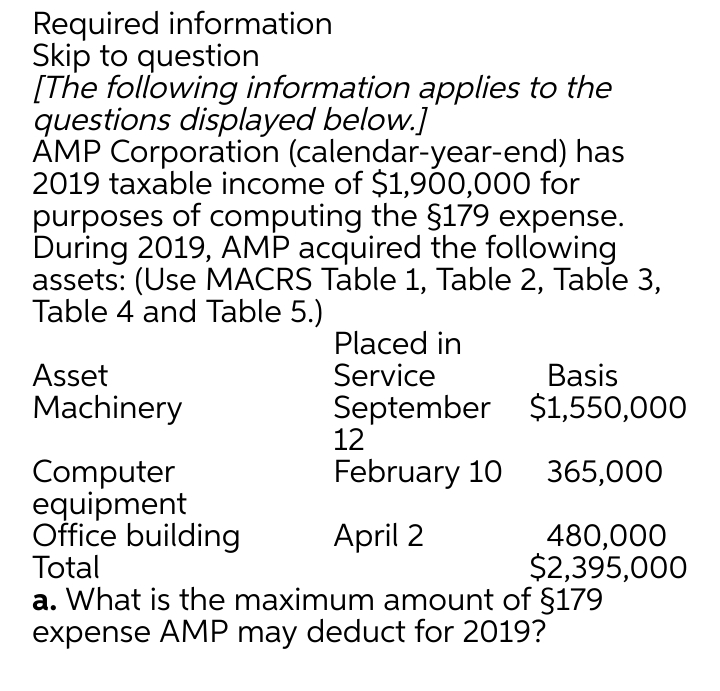

Solved Assume That TDW Corporation (calendar Year-end) Has | Chegg.com

Photo Credit by: www.chegg.com

Solved [The Following Information Applies To The Questions | Chegg.com

Photo Credit by: www.chegg.com

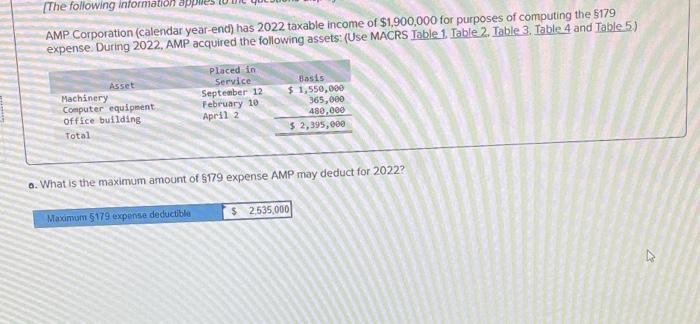

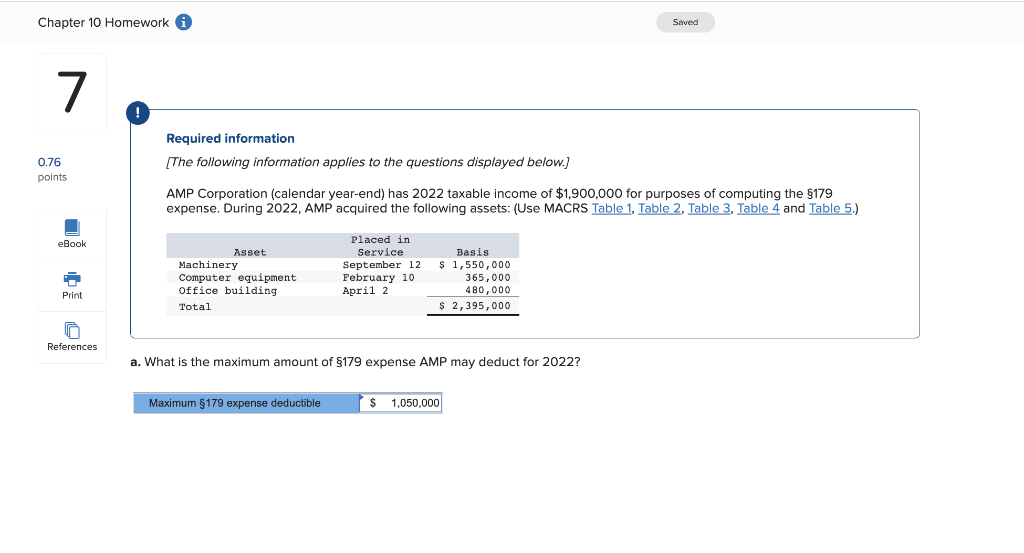

Solved A. What Is The Maximum Amount Of 179 Expense AMP May | Chegg.com

Photo Credit by: www.chegg.com

Assume Amp Corporation Calendar Year End Has 2022 | December 2022 Calendar

Photo Credit by: december2022.blogspot.com corporation assume answered bartleby

Required Information [The Following Information Applies To The

Photo Credit by: www.homeworklib.com

Solved AMP Corporation (calendar Year-end) Has 2021 Taxable | Chegg.com

Photo Credit by: www.chegg.com

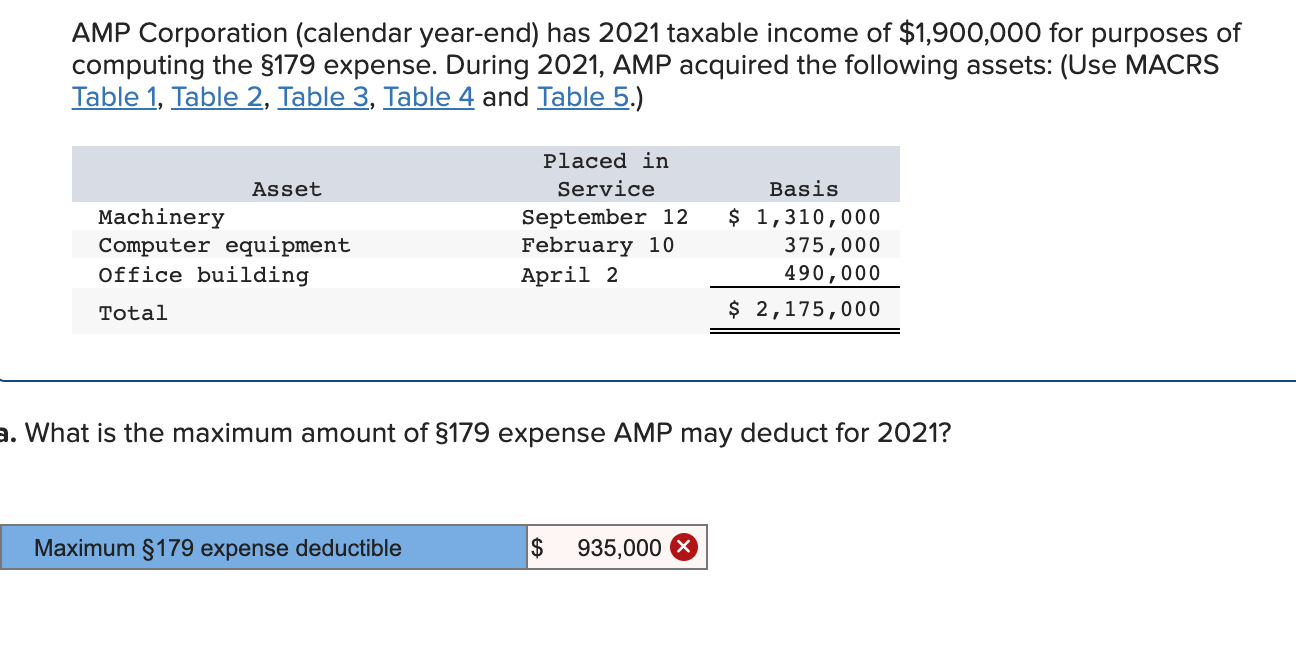

Solved AMP Corporation (calendar Year-end) Has 2021 Taxable | Chegg.com

Photo Credit by: www.chegg.com

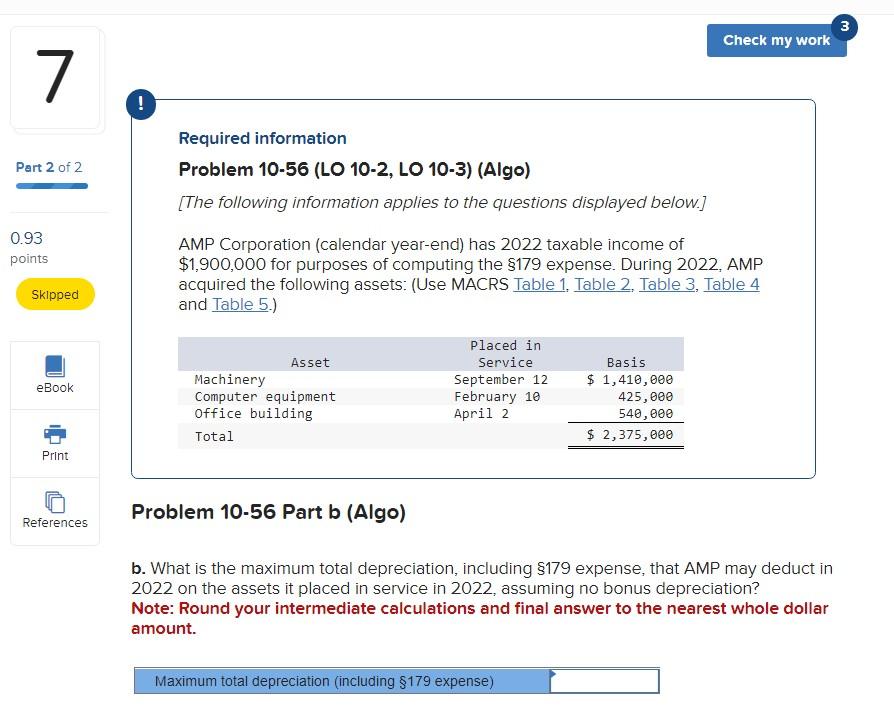

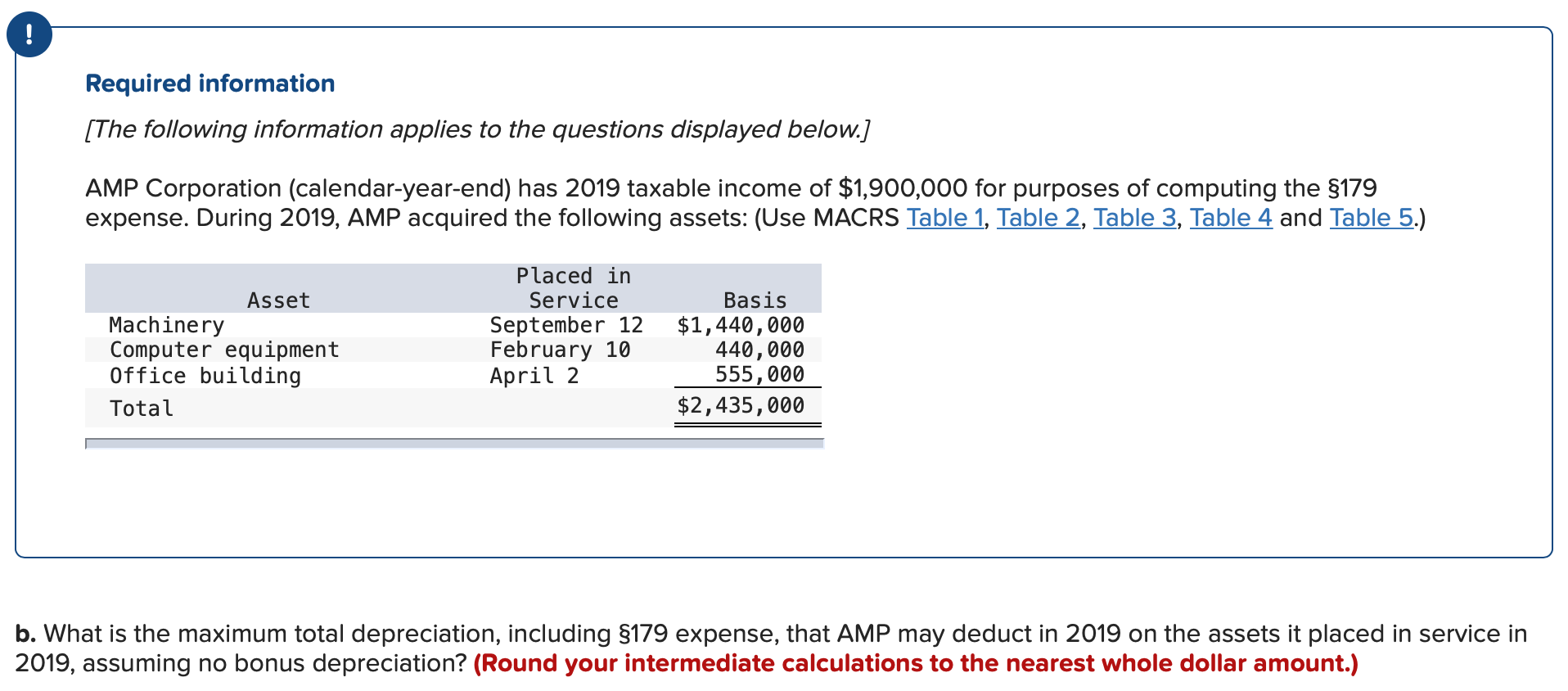

Solved Required Information Problem 10-56 (LO 10-2, LO 10-3) | Chegg.com

Photo Credit by: www.chegg.com

Assume That TDW Corporation (calendar-year-end) Has 2019 Taxable Income

Photo Credit by: www.homeworklib.com assume tdw corporation homeworklib computing taxable income

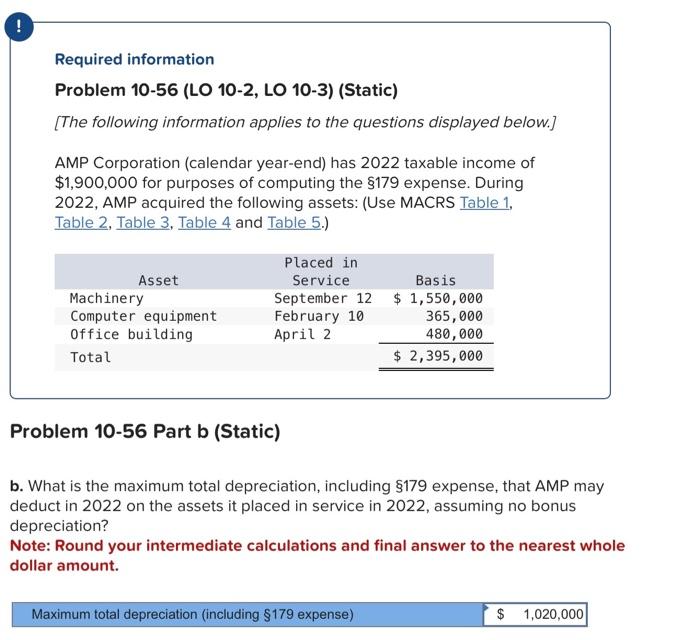

Solved Required Information [The Following Information | Chegg.com

Photo Credit by: www.chegg.com

Solved AMP Corporation (calendar Year-end) Has 2022 Taxable | Chegg.com

Photo Credit by: www.chegg.com

Assume Amp Corporation Calendar Year End Has 2021 | 2021 Calendar

Photo Credit by: haroldhedwig.blogspot.com problem acquires rueben warehouse lo calendar year homeworklib million september 2021 corporation assume amp month convention recovery depreciation period mid

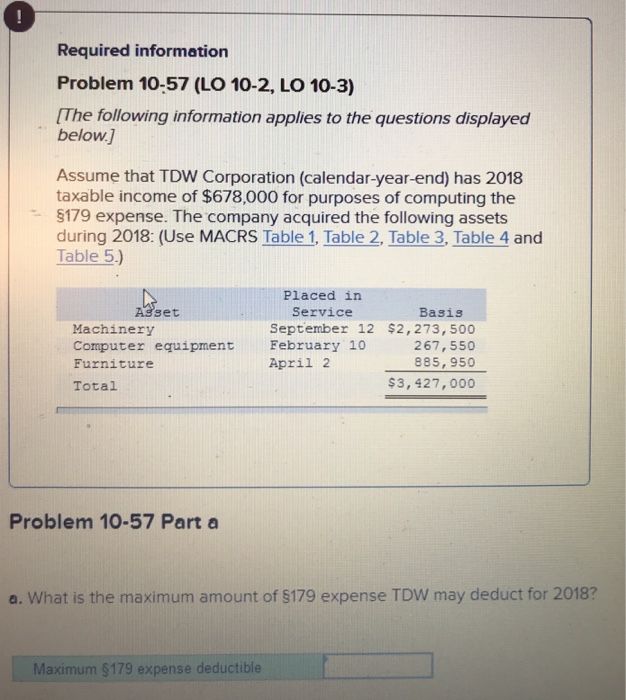

Solved Required Information Problem 10-57 (LO 10-2, LO 10-3) | Chegg.com

Photo Credit by: www.chegg.com problem following solved lo information expense tdw acquired income purposes taxable computing assume corporation calendar end during company year assets

Assume Amp Corporation Calendar Year End Has 2022 | December 2022 Calendar

Photo Credit by: december2022.blogspot.com 2022 following assume

Assume Amp Corporation Calendar Year End Has 2021 | 2021 Calendar

Photo Credit by: haroldhedwig.blogspot.com calendar 2021 intermediate 12th kieso accounting donald issuu canadian volume bank test edition assume corporation amp year

Solved AMP Corporation (calendar-year-end) Has 2019 Taxable | Chegg.com

Photo Credit by: www.chegg.com

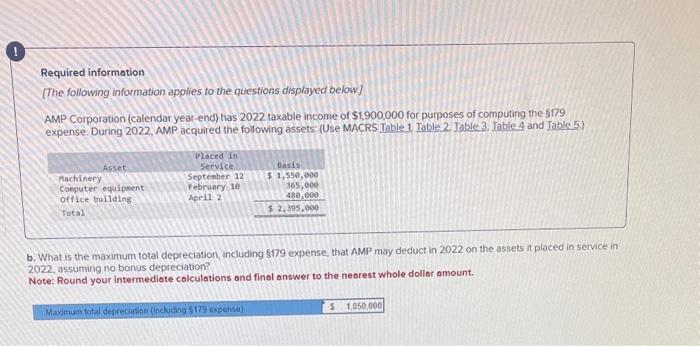

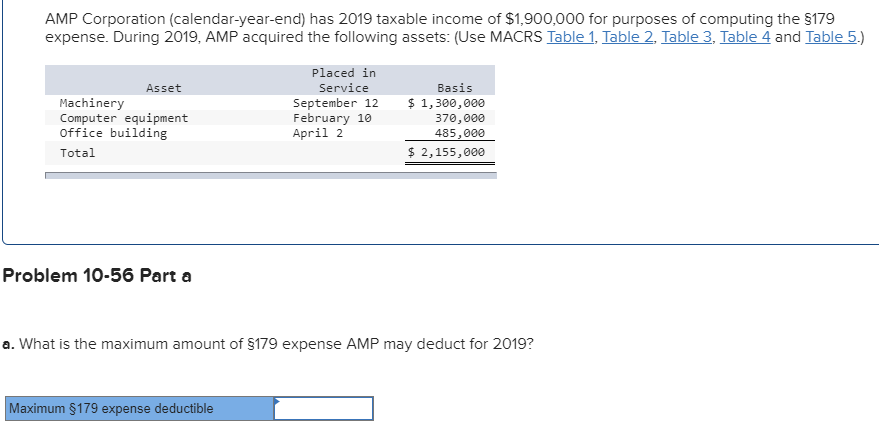

Solved A. What Is The Maximum Amount Of 179 Expense AMP May | Chegg.com

Photo Credit by: www.chegg.com

Assume Amp Corporation Calendar Year End Has 2024: Corporation assume answered bartleby. Solved assume that tdw corporation (calendar year-end) has. Problem following solved lo information expense tdw acquired income purposes taxable computing assume corporation calendar end during company year assets. Assume amp corporation calendar year end has 2021. Required information [the following information applies to the. Assume that tdw corporation (calendar-year-end) has 2019 taxable income. Solved amp corporation (calendar year-end) has 2021 taxable. Assume amp corporation calendar year end has 2022